Introduction: volume

Introduction: volume

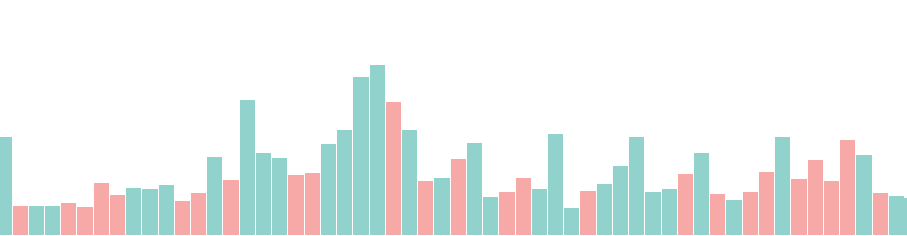

Volume is an important parameter in the stock market, which gives important information about overbuying and selling in the market.

Understanding Stock Market Volume:

1. Basically, the term “volume” refers to the total number of shares of a particular stock that have been traded during a certain time period.

2. It helps assess the strength and stability of price joins, so analysts and traders keep a close eye on volume.

3. Large increases in volume often accompany price changes, which signal investor interest and changes in the chart trend.

4. Conversely, low volume may indicate a lack of confidence in the market, leading to more unpredictable price changes.

Importance of Volume Analysis:

5. In technical analysis, volume analysis helps confirm trends.

6. In technical terms, volume is a confirmation indicator that supports or opposes the validity of price trends.

7. When stock prices are high, it indicates a healthy and sustainable uptrend, while when prices are low, it may indicate weakness.

8. Volume spikes during a downtrend can indicate panic selling, which can lead to oversold conditions and reversals.

9. Traders often use volume patterns to recognize potential breakouts, trend reversals, and entry/exit points.

Types of Volume Patterns:

10. It is important to monitor changes in volume to identify periods of buying (accumulation) or selling (distribution) in accumulation and distribution patterns.

11. Traders are helped to assess the strength of price gaps by analyzing breakouts and breakdown gaps through volume analysis.

12. On-Balance Volume (OBV) is a popular technical indicator that identifies potential trend reversals by combining volume and price changes.

13. Trading activity is clearly shown at different price levels on volume-by-price charts, which helps you locate support and resistance areas.

Interpreting Volume in Different Market Conditions:

14. In bull markets, rising prices accompanied by increasing volume often reflect increasing investor confidence.

15. In bearish markets, declining prices accompanied by increasing volume may indicate continued selling pressure and the continuation of the downtrend.

16. Volume analysis can be used to understand broad trends in particular stocks, market indices, or even the entire market.

17. Analysts use other technical indicators along with volume data to create comprehensive trading strategies.

18. Unusual volume spikes may be indicative of other events, news stories, or earnings releases affecting the stock.

19. Traders should be cautious when interpreting volume in periods of low liquidity (such as pre-market or after-hours trading).

Common misconceptions about volume:

20. Contrary to popular belief, high volume alone does not guarantee price movement; the quality of the volume is important.

21. Putting too much emphasis on volume alone without considering other factors can lead to the wrong decisions.

22. Volume analysis is most effective when used with fundamental analysis and other technical indicators.

Practical Tips for Traders:

23. New traders should become familiar with basic volume principles before incorporating them into their trading strategies.

24. Track average daily volume to determine whether current volume levels are noteworthy.

25. Regularly monitor changes in volume patterns, so you can keep track of changes in the market.

26. In different stock and market conditions, volume analysis is a dynamic tool.

27. Traders should constantly adapt their volume analysis techniques to market changes.

conclusion:

28. Stock market volume is a multidimensional indicator that captures investor sentiment and market dynamics.

Volume analysis, an important part of technical analysis, provides traders with an effective tool to deal with the difficulties of the stock market and make accurate decisions.

Disclaimer

Buying or selling financial instruments carries a significant degree of risk, and stockmarketup.in. makes no recommendations regarding this matter. Our readers and customers are free to choose to work with a registered investment advisor or to make their own trading and investment decisions, even though we provide instructional information on how to use our advanced stockmarketup.in trading tools. This article only represents the author’s opinions; stockmarketup.in or any of its affiliates do not endorse any viewpoints expressed here.I am not a SEBI-registered advisor or a financial adviser.

I do have not so many ideas about share trading but this article helps me give ideas about this matter.

ok sir thanks