Introduction: Moving average

Introduction: Moving average

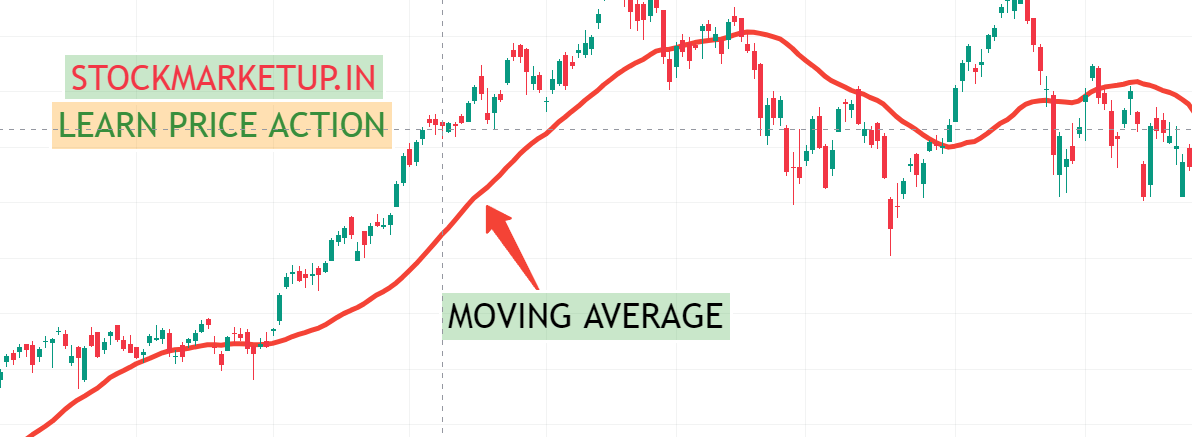

Moving average (MA) is a popular tool in technical analysis.

It plays an important role in smoothing the price data and provides a constantly changing average price for investors and traders to analyze market trends.

1. Purpose of calculation:

Primarily, a stock’s moving average is calculated to minimize the impact of short-term price declines.

Exponential moving averages (EMA) give more importance to recent prices, increasing sensitivity to market conditions, while simple moving averages (SMA) use the arithmetic mean.

2. Types and Roles of Moving Averages:

Moving averages, called lagging or trend-following indicators, are calculated based on past prices.

They are helpful in determining the support, resistance, and trend direction of a stock.

3. Effect of moving average period:

The amount of gap present is directly affected by the MA period.

The 200-day MA, which includes prices over the past 200 days, shows a larger lag compared to the 20-day MA.

The 50-Day and 200-Day MA are widely recognized, serving as essential indicators for potential trading moves.It

The MA period is preferred by investors.

According to the trading goals, investors choose the MA period.

Small traders want shorter periods, while long-term investors want longer periods.

4. Market Trend Predictions:

Research and technical analysis give more accurate predictions, but it is impossible to predict a stock’s movement.

MA on the upward side shows rising, while MA on the downward side shows down.

5. Types of Moving Averages:

There are two main types: the exponential moving average (EMA) and the simple moving average (SMA).

SMAs calculate simple averages using arithmetic tools over a certain period of time.

EMA calculation:

The smoothing factor in the EMA calculation is shown as [2/(selected time period + 1)].

This factor, combined with the prior EMA, influences recent prices more than older prices.

6.Trader’s Choice:

The trader’s preference for reaction determines whether to use the EMA or SMA.

EMAs react quickly to price changes, providing a weighted average that accurately reflects market dynamics.

7. Comparison of SMA and EMA:

The trader’s first preference is whether to use EMA or SMA.

EMAs respond quickly to prices and give a weighted average that accurately reflects market dynamics.

8. Drawbacks and Risk Management:

Moving averages, while widely used, have shortcomings and can generate false signals.

To minimize potential losses, especially during market volatility, efficient risk management techniques are essential.

conclusion:

In short, whether simple or exponential, moving averages prove to be highly useful to traders and investors, aiding trend identification and informed decision-making in dynamic financial markets.

Disclaimer

Buying or selling financial instruments carries a significant degree of risk, and stockmarketup.in. makes no recommendations regarding this matter. Our readers and customers are free to choose to work with a registered investment advisor or to make their own trading and investment decisions, even though we provide instructional information on how to use our advanced stockmarketup.in trading tools. This article only represents the author’s opinions; stockmarketup.in or any of its affiliates do not endorse any viewpoints expressed here.I am not a SEBI-registered advisor or a financial adviser.