Title: Know Supertrend Technicals: Steps to Success in Trading

Introduction

Amidst the dynamic financial markets, traders constantly look for effective analysis indicators to help them deal with the complex scope of trading. The supertrend indicator is an indicator that is very popular. In this blog post, we will examine the basic principles of the SuperTrend indicator and how it can be used to improve trading performance.

Understanding the Supertrend Indicator:

Understanding the Supertrend Indicator:

The SuperTrend indicator is a useful tool as it confirms trends and creates buy and sell signals for short and long trades. It is versatile and tells you the direction of the trend and the place of the stop loss!

The SuperTrend indicator can be used on all timeframes, and when layered with other indicators for a multi-timeframe approach, it can be a very profitable trading tool.

So the SuperTrend indicator is essentially a lagging indicator, meaning it is based on data.

It is also important that, as a trend-following indicator, it works best when the price is trending and not fluctuating.

Essentially, Supertrend indicators have two important parts:

ATR length and a multiplier.

Assigns the ATR length value to the historical range to calculate the average true range.

Adjusts ATr to be more or less than the multiplier value.

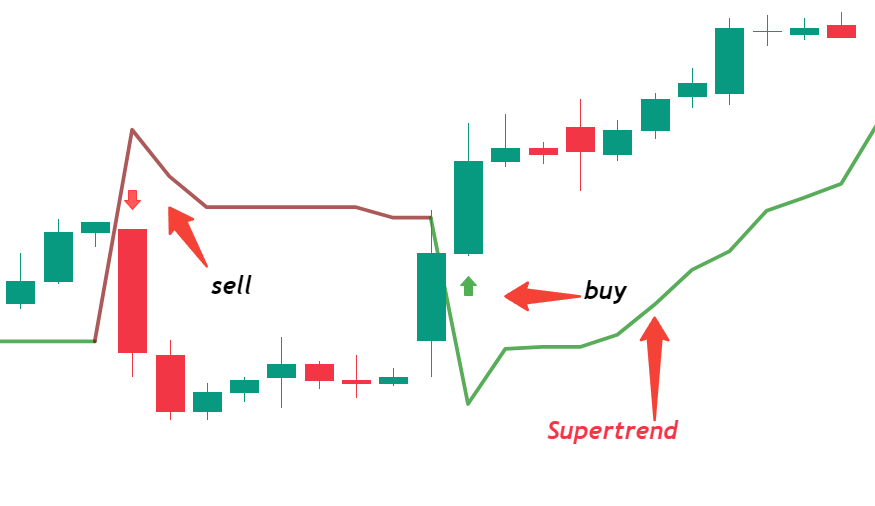

You can use these customizable values to finely adjust the sensitivity of the indicator to price declines. When the indicator changes from green to red, it signals bullish sentiment. From red to green The transition signals a shift from bearish to bullish. The Supertrend indicator thus shows the top (bearish) and bottom (bullish) zones, which are set at the values you input. With ATR Length 10 and Factor 3 While installed by default values, these can also be changed. The Super Trend indicator will give a buy or sell signal and change its bias when the price closes above or below one of these green or red zones.

Although it is important to know that, like all indicators, their interpretation is not so simple,. For example, green means “buy” and red means “sell.”.

Principles of Supertrend Strategy:

The Supertrend strategy is based on a simple set of ideas. The supertrend signal indicates a bullish trend and a potential buying opportunity when the price is below it. On the other hand, a bearish trend is indicated, and a potential selling opportunity is suggested if the supertrend is above the price. One of the main factors contributing to the strategy’s appeal to traders is its simplicity.

Adaptability to different deadlines:

The flexibility of the Supertrend strategy in adjusting to different timeframes is one of its main advantages. SuperTrend can be tailored to suit your preferred trading horizon, whether you are a long-term investor or a short-term day trader. It is a flexible tool that is suitable for traders of different interests and styles due to its adaptability.

Risk Management with Supertrend:

A key component of successful trading is risk management, and the SuperTrend Strategy is a useful tool for this purpose. To help identify their risk and keep their capital safe, traders can use the SuperTrend indicator to set stop-loss levels. The ability to systematically manage risk gives one the key to long-term trading success.

Combining Supertrend with other indicators:

Although the Supertrend strategy can be quite effective when used alone, some traders prefer to combine it with other technical indicators to increase its potential. Bollinger bands, the Relative Strength Index (RSI), and moving averages are frequently used indicators in conjunction with supertrends. These pairs can offer a more in-depth examination of market dynamics.

Backtesting and Optimization:

Perform extensive backtesting and optimization on charts before implementing any strategy into your trading system. This involves evaluating the performance of the Supertrend strategy in different market scenarios using historical data. Traders can go through this process to adjust the parameters and ensure that the strategy is in line with their trading goals and risk tolerance.

conclusion:

Success in the ever-changing world of trading depends on a solid strategy. The SuperTrend strategy has earned a place in many traders’ toolkits due to its ease of use, versatility, and risk management ability. However, like any strategy, it is important to understand its subtleties, conduct adequate testing, and maintain application discipline. Traders adopting the supertrend strategy may be able to gain profits when negotiating the complexities of the financial markets.

Good information for trading

Thanks, sir this appreciation.

A supertrend indicator is a trend determination of buying and selling is a stock market and so it is a nice tool that an avid learner in this domain can learn from this article.

It would be a trend determinator in the stock market. Nice sharing.