Title: Leading the Market with Neutrality: The Puzzle of the Neutral Candle Pattern

Title: Leading the Market with Neutrality: The Puzzle of the Neutral Candle Pattern

Introduction:

Traders and investors constantly look for signals to understand the changes happening in the stock market and take the right decisions. Among the variety of candlestick patterns, the neutral candle often attracts attention. In this blog, we will understand the features and importance of neutral candles and the important data they provide in the dynamic world of stock trading.

Body:

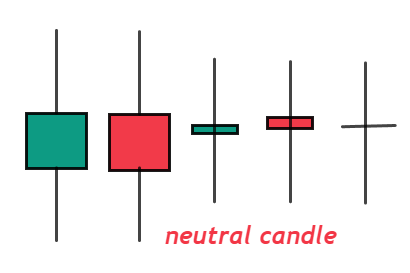

Neutral candles, often overlooked by their more massive counterparts, are characterized by a small real body, indicating a narrow price range between open and close.

Understanding the basics of the neutral candle pattern:

Neutral candle patterns include doji, spinning top, and small body candles, where the market’s decision and balance are clearly visible.

Doji Dilemma:

The doji market, whose opening and closing prices are almost identical, is a prominent member of the neutral candle family. Doji in its place can indicate the continuation or reversal of a trend.

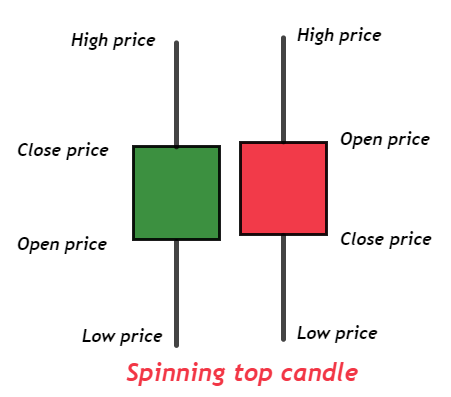

Spinning Tops: Equilibrium Act in the Market:

Spinning Tops: Equilibrium Act in the Market:

Spinning tops are small, actual candle bodies with upper and lower tails that show competition between buyers and sellers. These candles indicate changes in the market.

Enlightening Gravestone and Dragonfly Doji:

Enlightening Gravestone and Dragonfly Doji:

The gravestone and dragonfly doji are different variations of the doji pattern, which have different meanings. The dragonfly signals a potential bullish reversal, while the gravestone signals a bearish reversal.

Understanding the importance of a neutral candle:

The neutral candle, with its long shadow and small body, symbolizes market uncertainty. Traders often interpret this neutral candle as a continuation of the current trend or a potential trend reversal.

Small actual units, big implications:

Neutral candles with small, realistic bodies maintain balance between sellers and buyers. Although these candles may seem invisible, their presence can be important in detecting indecision and upcoming volatility in the market.

Applying the neutral candle pattern in trend analysis:

Traders can include the neutral candle pattern in their technical analysis toolkit to improve trend identification. Recognizing these patterns in the overall market context increases their predictive power.

Instability, contraction, and expansion:

Neutral candles often precede periods of volatile contraction, indicating the potential for market tension. Volatility may increase later, which may provide trading opportunities for those familiar with these small changes.

Role of confirmation in trading with a neutral candle:

The trader should seek confirmation from other technical indicators or chart patterns when deciding on the neutral candle. The credibility of the signals produced by these small market indicators is strengthened by this multidimensional approach.

conclusion:

In the broad sweep of the stock market, the neutral candle forms a silent but powerful symbol of indecision and balance. Traders who understand these simple patterns can spot hidden opportunities and navigate the complexities of the market with ease. Traders are invited by the puzzle of the neutral candle to understand market movements, add a little insight to their decision-making process, and develop a deeper understanding of the complex dance between buyers and sellers.