How to understand support and resistance forces: a comprehensive guide

Introduction:

It is important to do technical analysis in the tough world of stock trading. The topics that are important for a trader to know include the principles of support and resistance. In this detailed guide, we will explain the intricacies of support and resistance, their importance in shaping trading strategies, their identification, and their practical uses.

Understanding the Basics: Defining Support and Resistance

Support is a pillar of strength.

Support is a pillar of strength.

When a market or stock price moves downward, support is an important level. It is a safety net that prevents prices from falling. Traders often carefully analyze historical price data, trendlines, moving averages, and key psychological levels to locate support levels. Because there is buying pressure here

resistance—a persistent obstacle:

Resistance, on the other hand, is a level where the market or stock faces selling pressure, preventing prices from rising. This is a fatal barrier which hinders upward progress. Traders determine resistance levels by looking at technical indicators and analyzing historical data. There is selling pressure here. https://youtu.be/vQlEvyx_aOQ

Identifying support and resistance: a practical approach

Historical Price Analysis:

An important way to find support and resistance is to look in depth at historical price charts. Traders check for levels where prices have stalled, reversed, or experienced significant action.

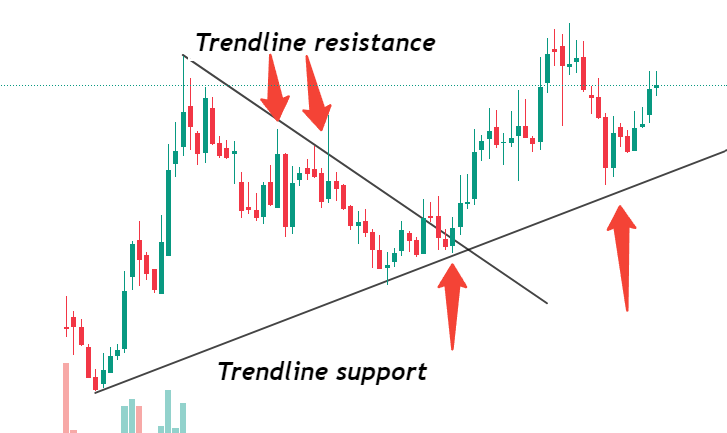

Trendline Analysis:

Trendline Analysis:

Signals of support and resistance can be shown by drawing trendlines on a chart. While a rising trendline often indicates support, a falling trendline often indicates resistance.

Psychological level:

Round figures of price, i.e., numbers like 100, 200, 300, 400, 500, etc., show the psychological level of resistance. It may be difficult to reduce or maintain prices of 100, which may lead to psychological barriers.

Volume

Volume is the ultimate indication of support and resistance strength. Because volume helps convey the momentum behind a trend, volume works in much the same way as preceding price movement as a signal, but why is volume a price signal? Higher volume levels lead to more selling and buying, potentially leading to better areas of support and resistance.

Practical Application: Taking advantage of support and resistance in trading

Strategic entry and exit points:

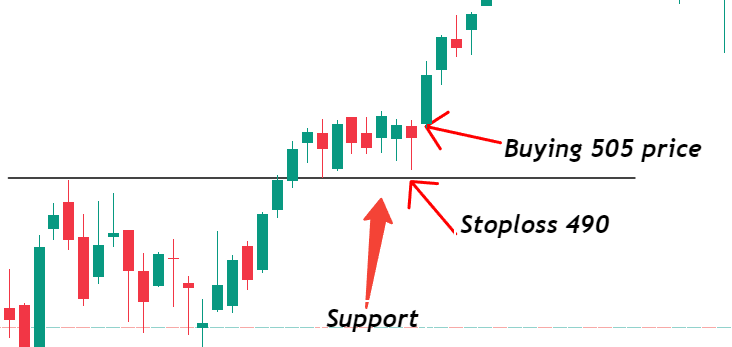

One of the most important uses of support and resistance is determining strategic entry and exit points. Traders often buy around support levels and sell around resistance levels to adjust for profitability.

risk management:

risk management:

Resistance and support are important in risk management. Placing stop-loss orders at support and resistance helps traders minimize potential losses and keep their capital safe.

Trend Confirmation:

How prices react to support and resistance levels helps determine the strength or weakness of a trend. Rejection is very useful on a sustained bounce off resistance in a downtrend or support in an uptrend.

Breakout and Breakdown Trading:

Traders look for opportunities above resistance or below support. These events often mark a potential trend reversal or the birth of new, beneficial trends.

Conclusion: Empowering Your Trading Journey

Traders need support and resistance technical analysis to understand market dynamics. By knowing these ideas, traders can make more intelligent decisions, adjust entry and exit points, and control risk effectively. Whether you are a novice or an experienced trader, incorporating support and resistance analysis into your strategy increases your ability to deal with the complexities of the stock market, making you a more confident and successful participant in the financial markets.

Nice information

Very valuable information. Thanks a lot.

thanks for the appreciation.